Secrets of Self-Made Millionaires by Adam Khoo

This is a very interesting book by Adam Khoo published in 2009. Today is 2022. After 12 years (one economic cycle), the principle of financial management did not change. Only the methods changed according to the social-economic development. In actual fact, Adam Khoo use this method 12 years ago and it still holds up. He talked about making multiple streams of income and he talk about the internet and digital economy. He leverages the internet to scale up his capability to make more money.

Takeaway 2: Delay gratification is an urban legend and it only applies to people who are in the middle class and above.

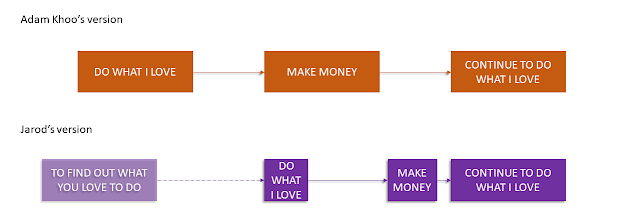

I do support the concept but I merely trying to modify the timeline from each stage to another stage. I am trying to provide a better graphic representation that it take a person to work hard for a very long time to make enough money to do what they love to do.

If you are interested in the book, you can purchase it from me at an extremely low price or you can buy it from any online bookstore. I will share with you the link at the end.

Here are a few key takeaways from me and I would like to share them with you.

Takeaway 1: Money is a game, do you know the rules to achieve your financial goal?

We all want more money. But what does money really means? What are the rules? Invest like crazy? Or Save like crazy?

If your monthly cash flow is negative. I wonder is there any more gratification that you can delay? Delay your lunch to dinner? Delay your RM 5 breakfast to RM1.50 nasi lemak?

If your monthly cash flow is negative but your earnings are above your needs, you know that you are this group of people. Then, I will say, delayed gratification will work for you. From buying iPhone 13 Pro Max, your old iPhone 8 still working well and take a good picture.

Takeaway 3: The ultimate goal (I think) for us is to do what we love to do.

But seems like the time lime in the book is a little bit distorted. Let me draw a new version and you will understand.

How to second diagram, here is my version.

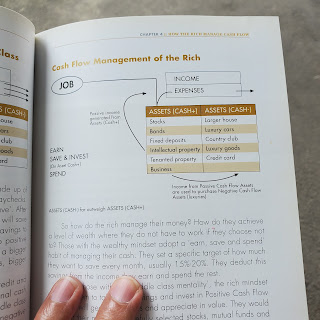

For people who gain insight and awareness to start with "do what I love", that will be amazing. But the majority of us take a very long time to find out what we really love to do and can do it for a long time. Thus, my advice is to start now and just do it. You will find out what you love to do along the way.Takeaway 4: Save, invest and spend. Everyone knows about this rule, but how many follow them? (refer to Takeaway 2)

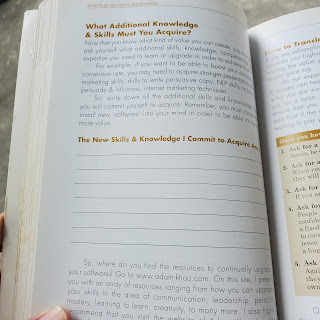

Everyone talks about investment and making more money. If you look around, from lowest risk to highest risk (gambling is not counted), you can get around 20% p.a? But how much is your spending in absolute spending amount p.a? For me to explain in mathematic numbers, you have to have assets that worth RM 1 million to give you rate of return 20% every year for you to spend RM200,000 every year. Sound easy? Let me know what do you think.Takeaway 5: If you are where you are now is because of what you did in the past. If you want to achieve a new goal, you need to do what you have not done in the past. That includes learning new knowledge and skill and applying them.

Takeaway 6: There are 4 ways to scale up your earning capability, which is your option?

In conclusion, this is yet another great book on financial education. Please feel free to grab one at Popular or MPH Online.

Once again, if you like my content, please remember to follow, like and comment. See you!

Comments

Post a Comment